Our Story

Northwoods Community Credit Union began as the Flambeau Paper Employees’ Credit Union in 1953. The Flambeau Paper Employees’ Credit Union, much like other credit unions all over the world, began with a simple idea: that people could achieve a better standard of living for themselves and others by combining their savings and making loans to neighbors and coworkers. People began pooling their money together because they had nowhere else to turn. They were able to work together and leverage money from each other in a way that helped each person achieve financial stability in difficult economic times.

A lot has changed since 1953, but one thing remains: Northwoods Community Credit Union continues to grow as a member-owned, locally controlled financial cooperative dedicated to providing financial security and outstanding service. We offer a complete range of services—from Savings and Checking Accounts, to a wide variety of lending products to serve your personal and business needs.

Today, NCCU’s field of membership consists of the following 14 counties: Ashland, Bayfield, Douglas, Forest, Iron, Langlade, Lincoln, Oneida, Price, Rusk, Sawyer, Taylor, Vilas, and Washburn.

Become an owner/member of Northwoods Community Credit Union and find out what the credit union difference is all about!

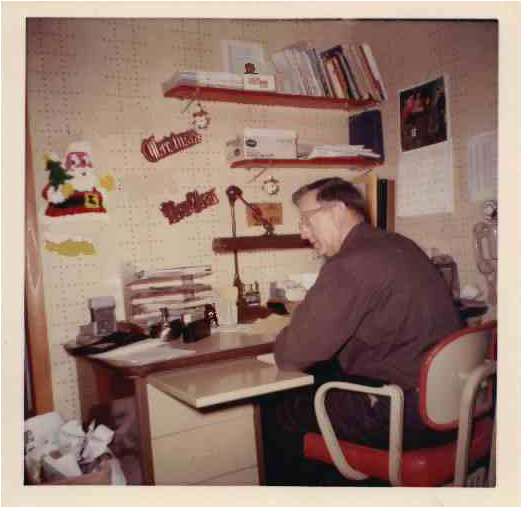

This photo, taken in 1963, shows the President of the credit union at that time, Lawrence Draxler, carrying out financial business for members in his basement.

Community

NCCU values the communities we serve and makes it a priority to support local groups and events. If your group would like to be considered for a donation, please submit the donation request form.

Forms can be mailed to:

NCCU

P.O. Box 369

Park Falls, WI 54552,

emailed to: receptionist@northwoodscu.com,

or dropped off at one of our NCCU offices.

Board of Directors

Roger Strand - Chairperson

Term expires 2026

Brandon Bay - Vice Chairperson

Term expires 2027

Darla Isham - Secretary

Term expires 2028

Joan Cooley - Treasurer

Term expires 2026

Peg Morgan - Director

Term expires 2027

Katie Weinberger - Director

Term expires 2027

Lori Becker - Director

Term expires 2028

Serving on the board requires someone who has a dedication to volunteer work, some knowledge of business or other requisite community interests, and/or a willingness to learn. They should have the time available to dedicate to the position. They need to be flexible, honest, and an independent thinker. Board members must be at least 18 years of age, a member in good standing, and pass a background check.

Duties and responsibilities:

The Director attends all monthly Board meetings. They need to have studied the information provided in the monthly Board packet and be able to discuss, question, or initiate new viewpoints concerning this information.

A Director needs to be committed to time spent working on committees that are important to the sound management of the credit union.

Once elected to a board seat, the newly appointed member must comply with the By-Laws. Also, additional education and training are required. In the term as a Board of Director, the individual will complete and pass training programs in a volunteer achievement program:

History and Philosophy

Financial Reports

Managing Risk

Board of Directors’ Duties and Responsibilities

Board and Management Policies

Planning

The Northwoods Community Credit Union Board of Directors represents a cross-section of the membership and the communities that NCCU serves. There are seven board members and once elected they serve a three (3) year term. To become a candidate for NCCU’s Board of Directors, you must be 18 years old and be a member of the credit union for three (3) months prior to the record date, which is set by the Board of Directors. Call us for more details if you would like to become a Director.